Derek Bryson Park, Ph.D. is currently Principal at Wilmington Capital Securities, LLC with the Royal Bank of Canada (“RBC”) serving as a clearing partner. With the vast majority of assets managed on a discretionary basis, Park is responsible for a myriad of individual accounts, as well as trusts and foundations.

Early Career

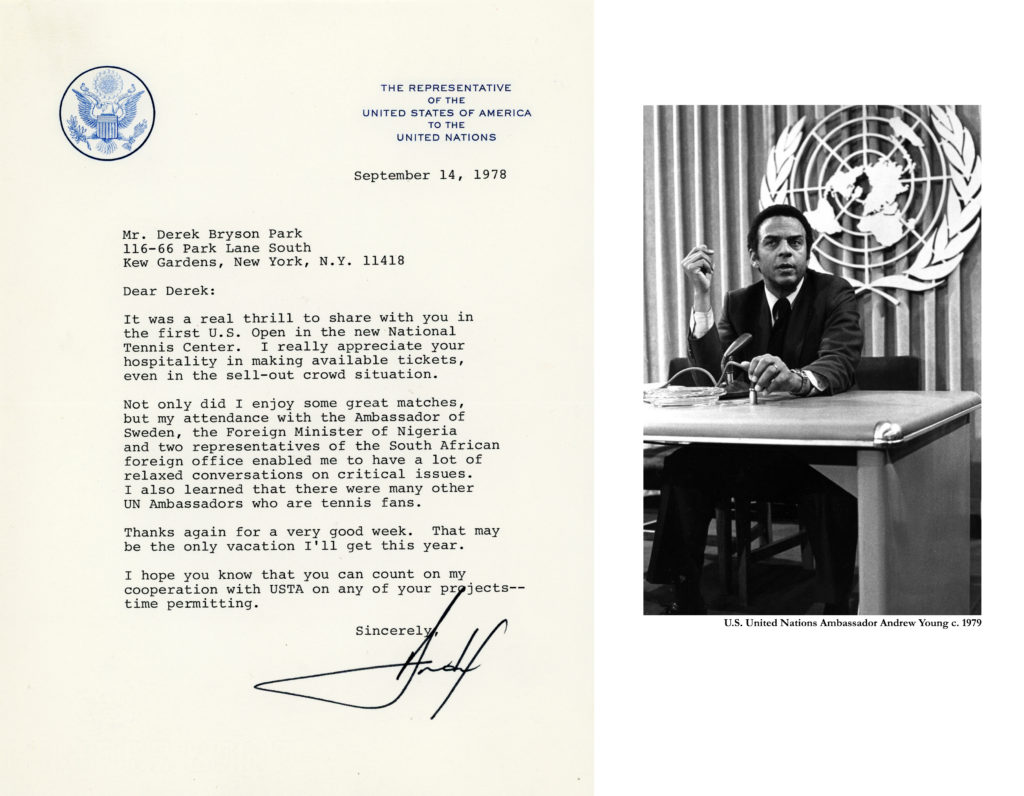

While attending university, Derek Bryson Park was made Manager of Stadium Operations of the US Open Tennis Championships at Flushing Meadows (1979) and Operations Manager of the WCT Tournament of Champions at Forest Hills, New York (1980-1982). Additionally, he was Operations Coordinator, World Championship Tennis Forest Hills Invitational (1978-1979); Operations Officer, Davis Cup Quarter-finals, USA vs. Czechoslovakia (1981); and Operations Officer, Robert F. Kennedy Pro-Celebrity Tournament (1978-1979).

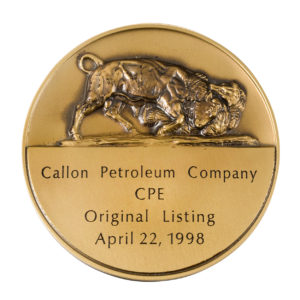

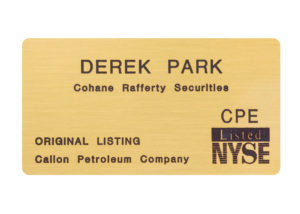

Upon Derek Bryson Park’s completion of graduate school in 1982, he went to work for Callon Petroleum Company where he helped raise over $225 million over a three year period from the sale of publically-traded drilling, income and royalty fund Limited Partnership programs and tasked with the management of a nationwide broker-dealer syndicate which included over 120 firms with Merrill Lynch serving as the lead underwriter.10 As the largest independent oil and gas exploration and production company in Mississippi, Callon Petroleum discovered more oil and gas [on shore] than any US-based corporation in America in 1982. He left Callon in 1983 to serve as Statewide Campaign Manager for the then Attorney General of Mississippi Bill Allain for whom he fundraised and campaigned in his succession run and election to Governor. Park was named Co-Chairman of one of the largest joint post-election rally/fundraisers in Mississippi State history debuting Mississippi Governor-elect Bill Allain and Louisiana Governor Edwin Edwards.

In 1984, he returned to Callon Petroleum Company reporting directly to the Chairman and CEO, John S. Callon.

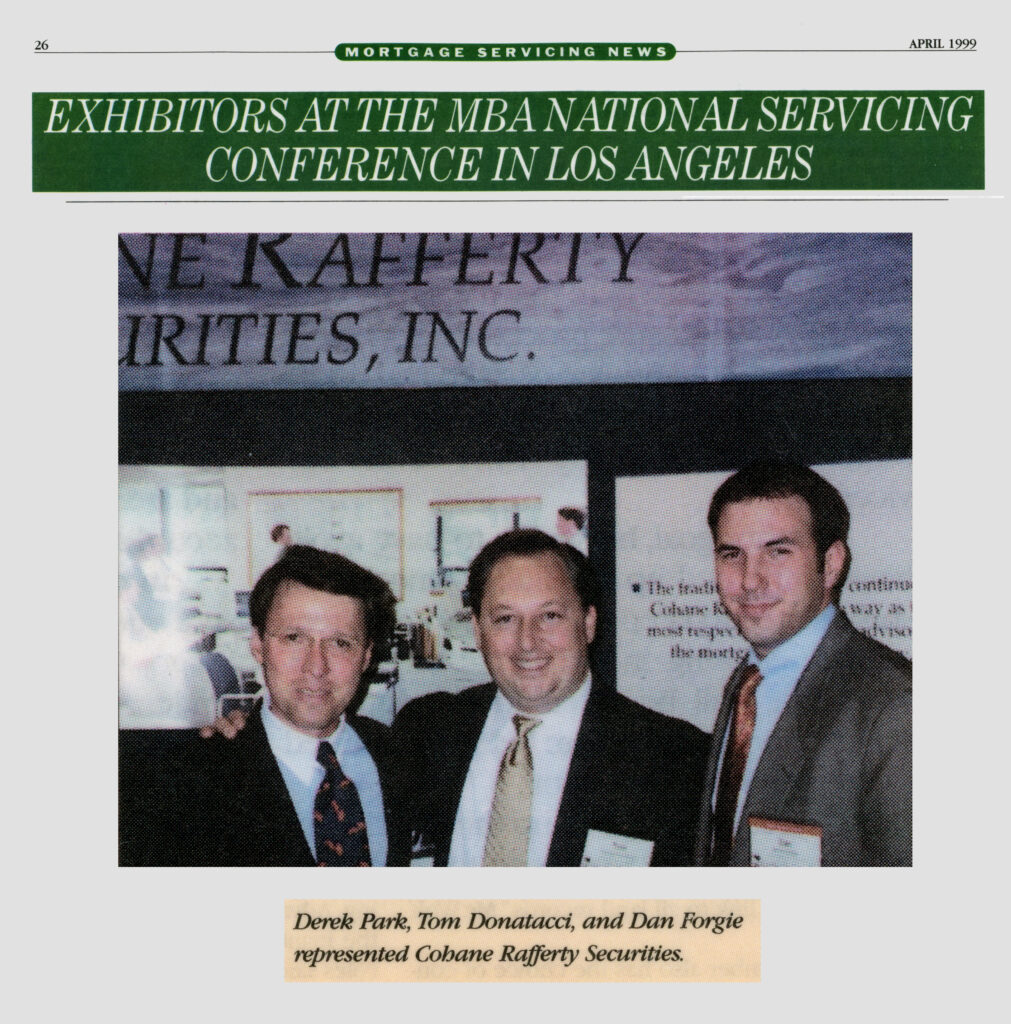

Cohane Rafferty Securities & Lehman Brothers

Preceding Lehman, Park was Managing Director of Rafferty Holdings, LLC (the holding company of Cohane Rafferty Securities, Inc. and other entities) and President of Cohane Rafferty Capital Markets, Inc. Recognized as one of the nation’s preeminent experts in mortgage finance, Cohane Rafferty had completed or evaluated over 4600 transactions involving more than $1.5 trillion of mortgage servicing rights, mortgage and consumer loans, credit card portfolios and mortgage banking companies.10

Significant M&A and portfolio transactions include:

- The sale of Wells Fargo Mortgage Bank to General Motors Acceptance Corporation;

- Structuring a strategic partnership between Cendant Corporation and Homeside Lending, Inc.;

- The sale of Capstead Mortgage Corporation to GMAC / RFC;

- Advising the Creditors Committee of Lomas Mortgage Corporation,USA in their retention of Cohane Rafferty and Lehman Brothers for the liquidation sale to First Nationwide;

- Stonehurst Ventures LP’s acquisition of Reilly Mortgage Capital Corporation from the Resolution Trust Corporation;

- M&T Bank in their joint venture acquisition with Key Bank of Goldome Federal Savings Bank from the FDIC;

- M&T Bank in their acquisition of Exchange Mortgage Corporation;

- The sale of First Denver Mortgage Corporation to Shorewood Financial Corporation;

- The sale of Elliot Ames Mortgage, Inc. to a U.S. financial institution;

[Left to Right] Founding Member and Chief Executive Officer of Rafferty Capital Markets, LLC, Larry C. Rafferty; Chief Executive Officer and President of Title Resource Group of Coldwell Banker, Donald J. Casey; Managing Director of JPMorgan Chase and former President of GMAC Bank, Robert Groody; and Derek Bryson Park at Old Marsh Golf Club, Palm Beach Gardens, FL. - The sale of $23 billion of mortgage servicing rights for Cendant Corporation / PHH US Mortgage which included a $10 billion Private Label forward bulk / flow arrangement with HomeSide Lending, Inc., a wholly-owned subsidiary of National Australia Bank;

- The industry-exiting sale of a $300 million servicing portfolio for GENSTAR Mortgage, Inc., a wholly-owned subsidiary of IMASCO, Ltd., a Canadian-based conglomerate;

- $1 billion of Ginnie Mae (FHA / VA) flow servicing for Washington Mutual Bank;

- $1 billion of conforming Fannie / Freddie servicing for BankAtlantic;

- $6 billion of conforming Fannie / Freddie / Private Investor product for First Franklin Bank;

- $3 billion of Fannie / Freddie Bulk / Flow production for Guaranty Bank and its wholly owned subsidiary, GN Mortgage;

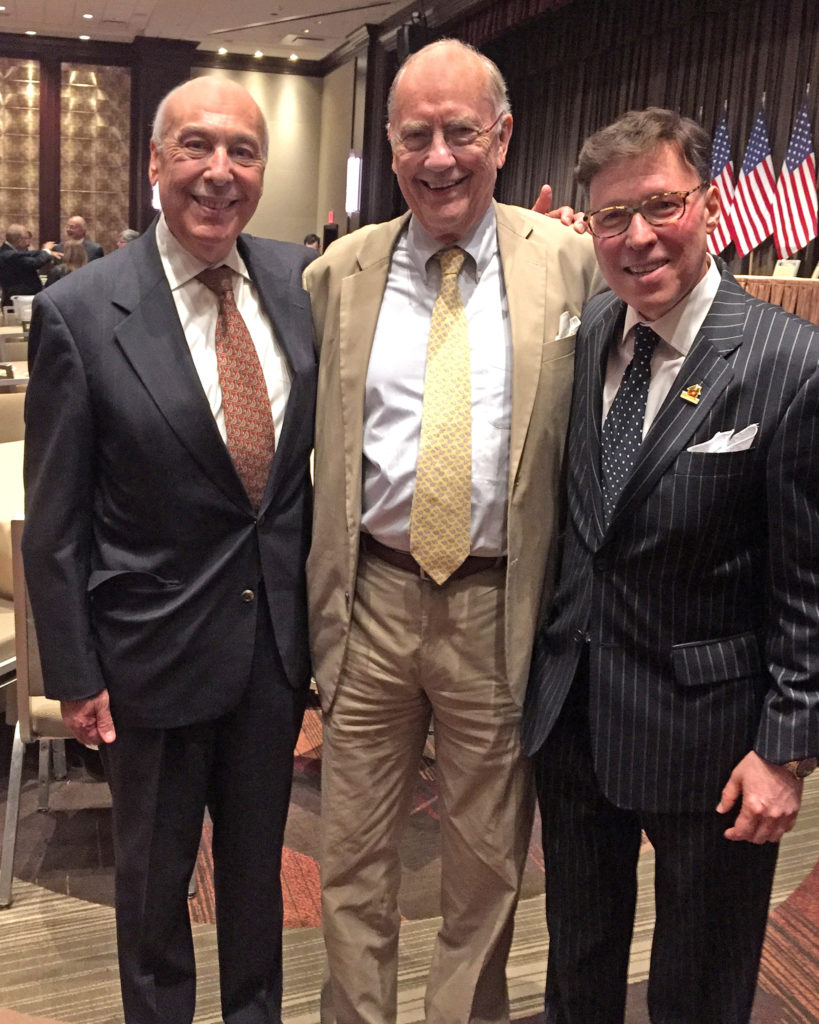

Derek Bryson Park with the Chairman of the “Financial Accounting Standards Board” (“FASB”), Robert H. Herz - $2 billion of conforming Fannie / Freddie and Jumbo Private Investor ARM product for American Savings Bank;

- $400 million of retail Ginnie Mae product for NBD / First Chicago through the sale of four separate portfolios;

- $700 million of Fannie / Freddie / Private Investor product for Allied Savings Bank;

- $800 million of conforming Fannie / Freddie for M&T Bank;

- $200 million of Fannie / Freddie / Ginnie / Private Investor for United Missouri Bank;

- Capstead Mortgage’s acquisition of 16 portfolios which, in aggregate, amounted to $26.3 billion, that included product sourced from Citicorp, Fleet Bank, Source One, Crossland, Caisse des Dépôts et Consignations (CDC), FBS, and, Weyerhauser;

- NationsBank’s acquisition of $3 billion of conforming flow servicing from People’s Heritage, Guaranty Bank, and, Dime Savings Bank;

- Chase Bank’s acquisition of $2 billion of conforming flow servicing from Inland Mortgage, and, Central Carolina Bank and Trust;

- Mellon Bank in their acquisition of $1.5 billion of Fannie / Freddie / Ginnie bulk / flow product from Chemical Bank, and, Globe Mortgage Company;

- American Savings Bank in their acquisition of $4 billion of Private Investor ARM product from RFC, North American Banking Company/ N.A. Corp., American Residential Mortgage Corporation, and, Lehman Brothers;

- Sourced multiple buy-side conforming and jumbo portfolios for First Republic Bank;

- A $60 million non-performing whole loan offering for United Jersey Bank to Ocwen Financial Group;

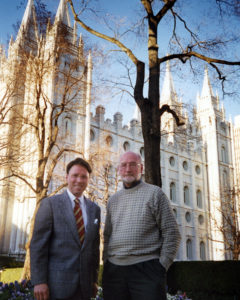

Derek Bryson Park and Cofounder and President of Cohane Rafferty Securities, Inc., Tim Cohane - A $200 million Home Equity offering for the Money Store to Dovenmuehle Mortgage;

- A $900 million performing credit card portfolio for Southeast BankCorp [this was the firm’s first credit card transaction, which paved the way for us becoming the nation’s Number 2 banker in the sale of charged-off portfolios];

- And, advised in the sale of mortgage servicing portfolios seized by the FDIC, Fannie Mae, and Freddie Mac from various failed / non-compliant financial institutions, including $423 million for Freddie Mac to Foster Mortgage; $156 million for Freddie Mac to Alliance Mortgage; $141 million for Freddie Mac to First Commercial; $181 million for Freddie Mac to Countrywide; $20 million for Fannie Mae to Carold Mortgage Corporation; and, $100 million for FSLIC / FDIC to Equitrust Mortgage;

Park also served as a Managing Director of the Potomac Funds, a leading provider of leveraged index and alternative-class mutual fund products (which was renamed Direxion Funds in 2006).